Vietnamese Tea 2023–2024: Journey of overcoming difficulties and affirming position in the world market

1. A year of many changes

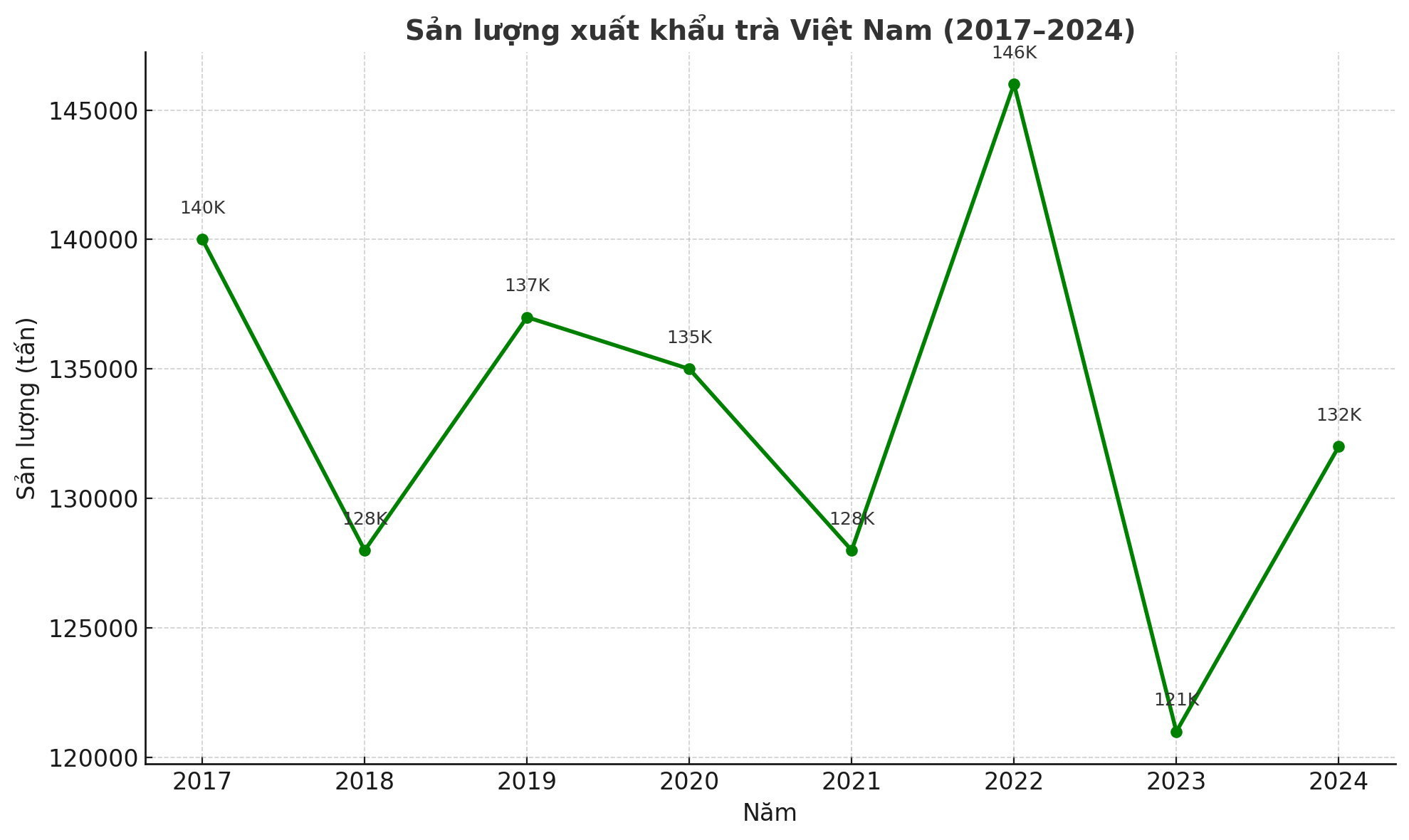

In 2023, the Vietnamese tea industry will face many challenges. Exports will only reach about 121,000 tons, equivalent to 211 million USD, down nearly 17% in volume and 11% in value compared to 2022. This is the lowest level in many years, reflecting the impact of climate change, pests and especially fluctuations from increasingly strict import markets.

However, by 2024, the tea industry has made a strong comeback. As of November, Vietnam had exported more than 132,000 tons, worth 234.7 million USD – up 25% in volume and nearly 27% in value compared to the same period last year. The average export price also reached ~1,765 USD/ton, showing a positive signal of competitiveness.

2. Causes and influencing factors

The fluctuations of the tea industry are influenced by many factors:

- Climate and season: In 2023, unusual weather caused productivity to decrease and tea leaf quality to be uneven.

- Global market: The trend of consuming high-end, organic tea and strict import regulations force Vietnamese businesses to raise production standards.

- Technology and processing: Most Vietnamese tea is still exported in raw form, with lower value compared to countries that have built strong brands such as Japan or Sri Lanka.

Vietnam tea export output chart 2017–2024

📉 2023 dropped sharply to 121K tons, the lowest level in many years.

📈 2024 rebound to 132K tons (to T11).

3. Sustainable direction – From quantity to quality

If in the past, the Vietnamese tea industry was known for its advantages in area and output, now quality and brand are the key. The formation of concentrated raw material areas, the application of international standards, and the development of high-end tea lines such as Oolong, lotus, Shan Tuyet, etc. will help increase the value.

In particular, e-commerce and online export channels are opening up great opportunities for Vietnamese tea to access demanding markets such as the EU, the US, and Japan. This is the path for products to not only go further, but also “go deeper” into the minds of international consumers.

4. Optimistic signals and future expectations

According to forecasts, by 2030, Vietnam can export about 136,500 tons of tea, accounting for 80% of domestic output, with a turnover exceeding 250 million USD. More importantly, if a strong brand is built, Vietnamese tea can completely rise to become a “national tea” recognized by the world, similar to Darjeeling (India) or Uji (Japan).

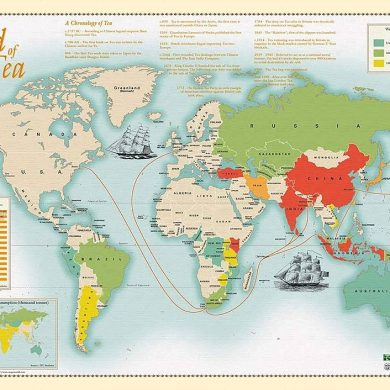

The Vietnamese tea industry is continuing its story: from a “traditional agricultural product” to a “national brand” on the world map. The growth figures for 2024 not only have economic significance, but also demonstrate the resilience to overcome difficulties and the desire to affirm the value of Vietnamese tea.

Each cup of tea is not only the crystallization of the earth, sky and climate, but also contains the belief: “Vietnamese tea is the quintessence of the land, the aspiration to reach far”.

Add comment